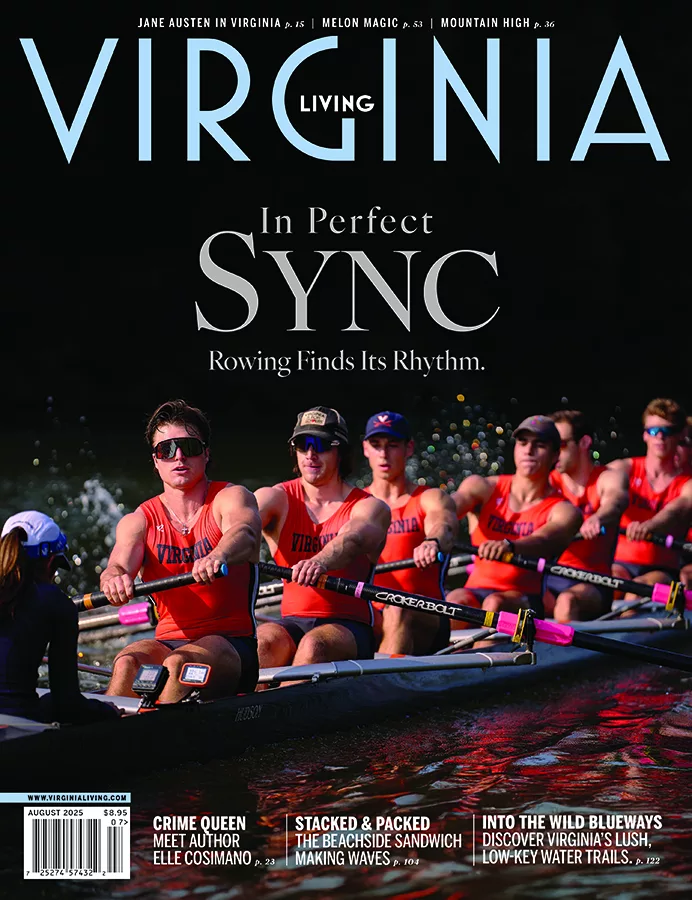

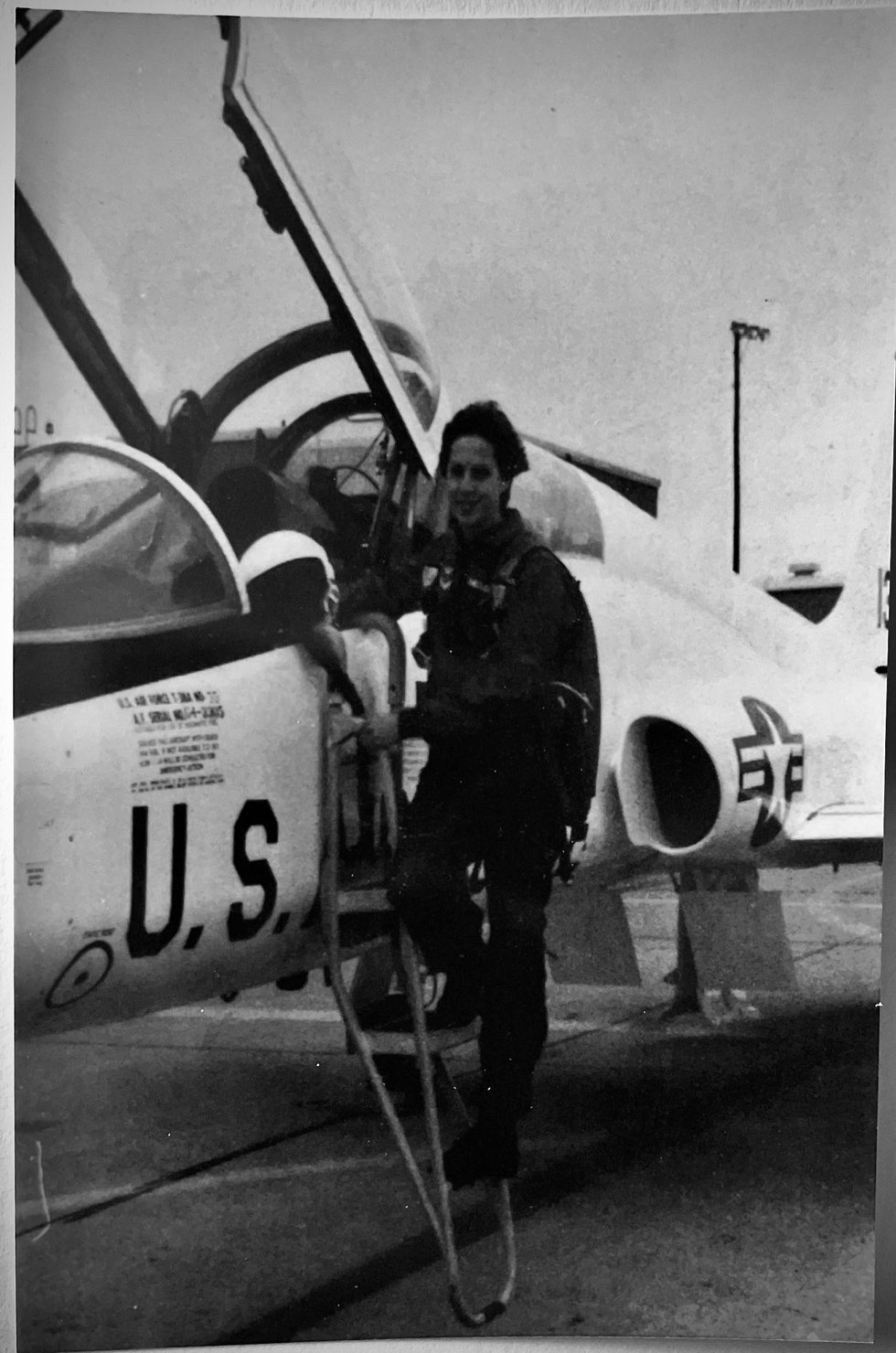

Mary Blissard became a certified retirement coach after seeing the struggles of her fellow pilots, who’re required by the FAA to retire at age 65.

“You feel like you’re walking off a gangplank.” Many retired pilots find themselves grounded at home.

Jane Dyer of Easley, South Carolina, hired Mary Blissard six years ago when she was first thinking about retirement. She knew pilots often had a tough time turning in their wings.

During retirement coaching, the Federal Express pilot discovered that she wanted to spend time volunteering and traveling with family, and that she wanted to retire early, at 60.

But in talking with Blissard, she realized that before she retired, “I wanted to make sure that I had been able to accomplish everything in my career that I wanted to do.” She ended up spending her last few years in aviation piloting a Boeing 777 around the world—the pinnacle of her career.

Retirement Coaches

Dyer is happy in retirement, with no regrets about retiring early. As for retirement coaching, “I was so glad I did it. It triggered so many things that you should think about, be prepared for,” she says. “It was well worth the time, energy and effort even though you might surprise yourself with some of your answers.”

Mary Blissard became a certified retirement coach after seeing the struggles of her fellow pilots, who’re required by the FAA to retire at age 65.

“You feel like you’re walking off a gangplank. It’s so arbitrary,” says Blissard, a pilot for over 40 years, who later served as chair of the retirement and insurance committee for the D.C. counsel of the United Airlines pilots’ union.

Many retired pilots grapple with identity issues. Others, used to a busy travel schedule, find themselves grounded at home—often with a spouse they aren’t used to seeing all the time. Relationship problems and even health issues may develop for some.

Blissard, who sees clients from a variety of occupations virtually and in-person in her Leesburg practice, Flying Forward in Retirement, says pilots are not alone.

“Especially with the baby boomer generation, work is a reason for being and tied closely to identity,” she says. “With retirement, there can be a lot of grief involved, from losing status or position and connection with coworkers, to not feeling that sense of fulfillment and being acknowledged.”

Retirement Coaches

Many think of retirement planning as only having to do with finances. But as baby boomers turn 65 at the rate of 10,000 per day, many struggle with the idea of finding meaning in retirement. That’s where retirement coaches can help.

Some clients have a clearer picture than others about how to spend their days. “Sometimes, ‘I don’t know what I want to do’ is a starting point,” says Blissard. Her coaching process usually takes from three to five sessions of about one hour each. She offers a free initial consultation.

Blissard begins with a personal inventory, often including psychological assessments. These findings can lead to explorations of various paths and action points, which clients undertake as part of their homework. They look at factors that might impact their plans, including conflicts with significant others or children.

“A lot of times people retire and their loved ones think ‘OK, now they’re going to have all the time in the world to take care of my needs or their grandchildren’s needs.’ There’s an assumption there and that really can be a problem if you don’t address it ahead of time,” she says. Since Blissard is not a therapist, she may suggest clients seek professional help for especially thorny issues.

As millions of Americans age, the need for retirement coaches is on the rise. Now, some companies are beginning to offer the service as an employment benefit.

Sarah Friedell O’Connell, a certified retirement coach and career management specialist who owns ChangePoint Advisors in Boston, focuses on job transitions for C-suite executives with major corporations. Her practice is both virtual and in-person. In addition to requests by individuals, she’s recently seen an increased demand by HR departments for personalized retirement coaching for their top-level employees and webinars for the broader employee base.

O’Connell often begins working with retiring senior executives five years before their departure, usually in tandem with succession planning.

Retirement coaches

“If you’ve been a chief executive officer or a president, a chief financial officer or a partner in a law firm, leaving that identity and stepping away from that kind of work can be very difficult,” says O’Connell, who previously served as a corporate communications executive and spokeswoman at Fidelity Investments and Harvard University. “Sometimes folks don’t want to retire because they just can’t figure out what they would do next, and who they would become.”

O’Connell offers a three-part executive retirement readiness program that begins with comprehensive reflection and in-depth conversations with the clients about how they want to spend their time now that they will no longer be working 40-plus hours a week. She collects data through psychological assessments, then helps them develop short- and long-term visions and goals.

“We take a holistic view, we look at their health, their leisure, what kind of work they might want to layer in—whether it’s paid or unpaid—their family and friend relationships, their geography. Maybe they want a different climate or be closer to family members or friends,” she says.

She helps them create a strategy and plan, including a portfolio of interests to get a concrete structure to their days. The final step is plan implementation. She follows the clients as they make their exit from the organization and into their next chapter. Sometimes, clients choose surprising paths.

Retirement Coaches

One of O’Connell’s clients, a former chief human resources officer for a large life-sciences corporation, continues to work part-time as a consultant. But among her activities, she also takes great joy helping customers one day a week at her favorite women’s clothing store.

Another client, who sold his business and moved with his wife to their vacation home, always dreamed of being a policeman when he was young. Today, he enjoys boating through the waters of his lake community as a part-time member of the marine patrol—part of the New Hampshire State Police.

Having the support of an objective third party can help people think outside the box as they move towards retirement.

“We’re not their boss, their spouse, or their friend. But we come to them as experts in the art of transition,” O’Connell says. “We help them move into the next stage with confidence and clarity.” ChangePointAdvisors.com, FlyingForwardInRetirement.com

Sandra Shelley writes for magazines and nonprofits and is a Senior Digital Content Specialist for the University of Richmond.